Payroll Mate provides a wealth of features including the ability to automatically calculate net pay, federal withholding tax, social security tax, Medicare, state and local payroll taxes.

#WHO MAKES PEACHTREE ACCOUNTING SOFTWARE SOFTWARE#

Peachtree accounting software users can take advantage of a special discount offered by Real Business Solutions as Payroll Mate 2013 and Payroll Mate 2014 are offered as a bundle for $180.00 only. We invested a lot of engineering time and effort to ensure that this feature would work well for our customers," says Payroll Mate product manager Nancy Walters. "The Peachtree export module inside Payroll Mate® is one of the most advanced, yet easy to use Peachtree integration utilities available in the industry. The Payroll Mate team is available by phone, chat and email to help new users get up and running as fast as possible.

#WHO MAKES PEACHTREE ACCOUNTING SOFTWARE TRIAL#

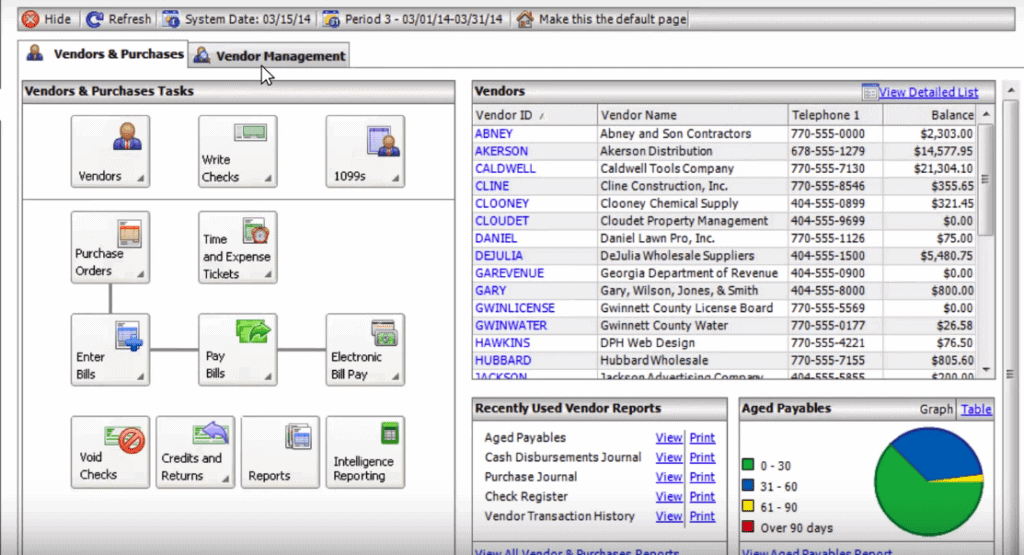

Peachtree users looking for new payroll software can download a free trial of Payroll Mate by visiting. Payroll Mate® offers an easy-to-use export capability to Peachtree (Sage 50), powerful employee data import engine with dedicated support for Peachtree, always-up-to-date payroll tax formulas, check and paystub printing features, payroll direct deposit module, 1099 vendor payroll management center and more.

Payroll Mate® ( ) is trusted by thousands of companies all over the country including accounting firms, architectural companies, educational institutions, construction companies, medical practices, hotels, banks and more. The 2014 edition of Payroll Mate® offered by Real Business Solutions makes importing and exporting payroll data to and from Peachtree accounting software a breeze. The new payroll software for Peachtree accounting offers a great alternative for Peachtree (Sage 50) users looking for affordable payroll system to run payroll in house, pay employees, calculate taxes and print payroll checks.

0 kommentar(er)

0 kommentar(er)